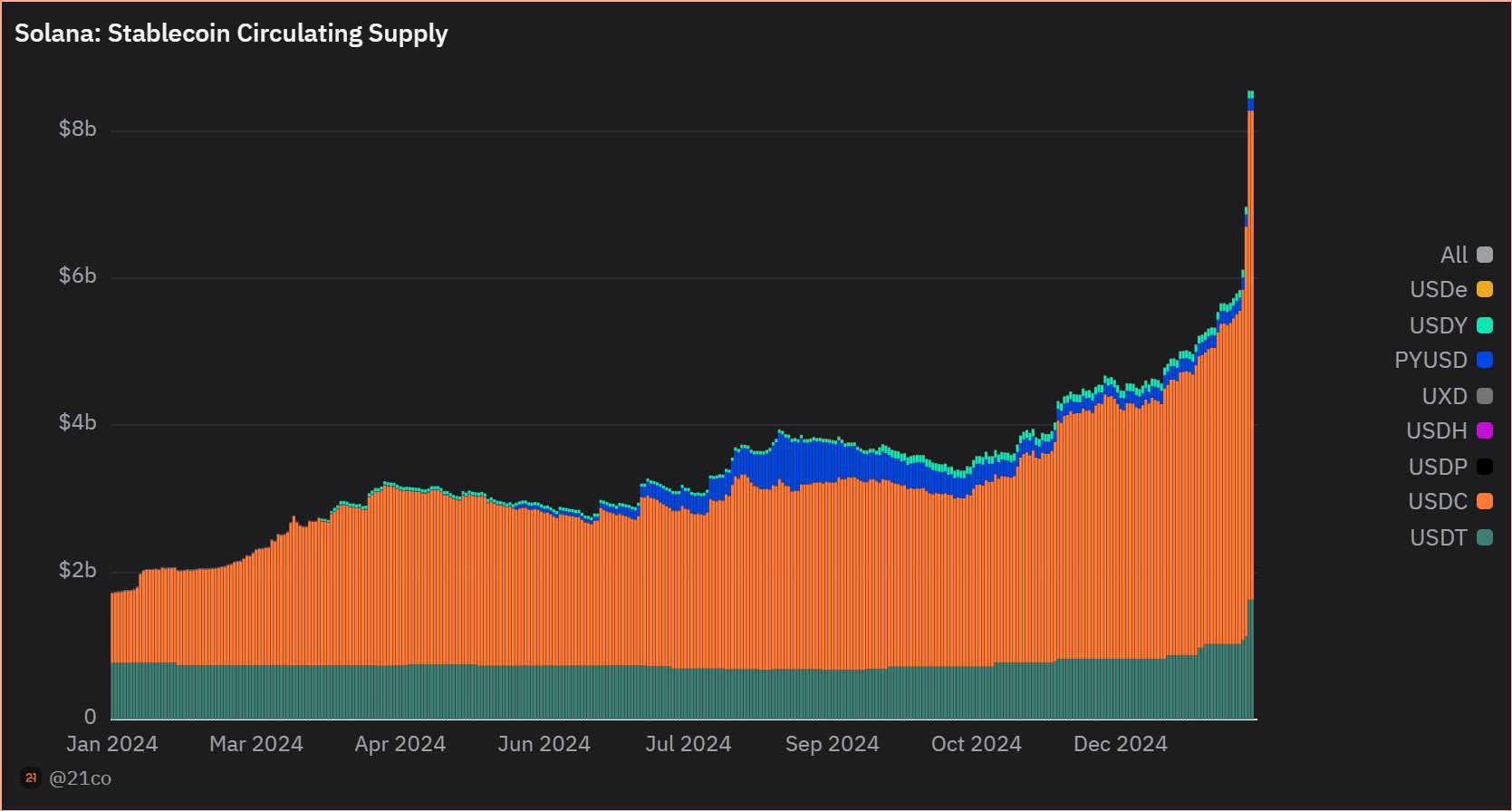

Solana Stablecoins Hit $13.4B ATH: Visual Insights Into 2025’s Explosive Growth

Solana’s stablecoin market has shattered expectations in 2025, reaching a new all-time high (ATH) of $13.4 billion in total supply as of September 27,2025. This explosive growth, up a staggering 168% from just $5 billion at the start of the year, signals more than just a headline milestone. It marks Solana’s transition from a fast Layer 1 blockchain contender to a central pillar in the decentralized finance (DeFi) ecosystem. As stablecoins become the connective tissue between traditional finance and blockchain-native economies, Solana is stepping into the spotlight with unprecedented momentum.

Solana Stablecoin ATH: Breaking Down the $13.4 Billion Surge

The numbers tell a compelling story. In January alone, Solana’s stablecoin market cap more than doubled from $5.1 billion to $11.4 billion by month’s end (Cointelegraph). By late September, that figure climbed to $13.4 billion, reflecting sustained inflows and deepening liquidity across DeFi protocols and exchanges.

The lion’s share of this growth is driven by Circle’s USD Coin (USDC), which now accounts for approximately 77% of all stablecoins circulating on Solana. Early in 2025, Circle minted an additional $250 million USDC on Solana, pushing the total USDC minted on-chain to $6 billion by February (cryptonews.net). This dominance isn’t simply about numbers; it reflects institutional confidence in Solana’s network speed, reliability, and growing developer activity.

Visual Insights: How Solana Stacks Up Against BNB Chain and Beyond

This surge is not occurring in isolation. The broader stablecoin market reached $251.7 billion globally by June 2025 (Reuters), up 22% year-to-date amid regulatory clarity and new use cases for digital dollars worldwide. Yet it is Solana’s rapid acceleration that stands out when compared to rival blockchains like BNB Chain and Tron.

Solana has consistently ranked among the top three chains for stablecoin activity since late 2024 (DefiLlama). What gives it an edge? Ultra-low fees paired with sub-second transaction finality have made it increasingly attractive for both retail users seeking efficiency and institutions demanding scale. In contrast with BNB Chain’s slower pace of stablecoin expansion this year, Solana’s network effect appears self-reinforcing: more liquidity attracts more protocols, which further boosts usage and volume.

The Strategic Role of Stablecoins in the Expanding Solana Ecosystem

Beneath these headline figures lies a deeper transformation within the Solana ecosystem in 2025. Stablecoins are no longer just trading pairs or on-ramps; they are underpinning lending markets, derivatives platforms, cross-border payment rails, NFT marketplaces, and even gaming economies built atop Solana.

Key Drivers of Solana’s Stablecoin Surge in 2025

-

USDC Dominance on Solana: Circle’s USD Coin (USDC) accounts for approximately 77% of all stablecoins on Solana. In early 2025, Circle minted an additional $250 million USDC on Solana, bringing the total USDC minted to $6 billion by February.

-

Record Stablecoin Supply Growth: The total stablecoin supply on Solana reached an all-time high of $13.4 billion in September 2025, reflecting a remarkable 168% increase since the beginning of the year.

-

Expanding DeFi Ecosystem: Solana’s rapid network activity and integration with decentralized finance (DeFi) platforms have driven demand for stablecoins, which are essential for liquidity provision and seamless transactions.

-

Favorable Regulatory Developments: The U.S. Senate’s passage of a stablecoin regulation bill in June 2025 has provided greater legitimacy and a clear framework for stablecoin growth, boosting institutional and user confidence.

-

Broader Stablecoin Market Expansion: The global stablecoin market cap hit $251.7 billion by June 2025, up 22% year-to-date, reflecting increased adoption and a supportive macro environment for Solana-based stablecoins.

This dynamic is reinforced by regulatory developments such as the U. S. Senate passing a bill to regulate stablecoins this summer – an event widely seen as legitimizing digital dollars as mainstream financial instruments rather than speculative tools (Reuters). As compliance frameworks mature globally, expect further institutional adoption and integration into payment networks.

Looking Ahead: Can This Momentum Last?

The question now facing investors and builders alike isn’t whether Solana can sustain this pace – but how far its flywheel can spin before reaching equilibrium with Ethereum or overtaking rival chains altogether.

Solana (SOL) Price Prediction 2026-2031

Professional outlook based on Solana’s 2025 stablecoin surge, DeFi adoption, and evolving regulatory landscape.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg YoY) | Key Scenario Insight |

|---|---|---|---|---|---|

| 2026 | $180.00 | $260.00 | $340.00 | +26.8% | DeFi expansion, stablecoin growth, regulatory clarity |

| 2027 | $210.00 | $320.00 | $430.00 | +23.1% | Institutional adoption accelerates, Layer 1 competition rises |

| 2028 | $250.00 | $390.00 | $540.00 | +21.9% | Solana ecosystem matures, cross-chain integrations |

| 2029 | $290.00 | $470.00 | $670.00 | +20.5% | Stablecoin utility mainstream, new use cases emerge |

| 2030 | $340.00 | $560.00 | $820.00 | +19.1% | Wider DeFi & TradFi bridge, improved scalability |

| 2031 | $400.00 | $660.00 | $1,000.00 | +17.9% | Mass adoption, global regulatory harmonization |

Price Prediction Summary

Solana (SOL) is projected to see steady price appreciation through 2031, fueled by exponential growth in stablecoin supply, robust DeFi activity, and a favorable regulatory environment. The average price is forecasted to more than triple from 2025 levels by 2031, with bullish scenarios reaching as high as $1,000. However, volatility and competition among Layer 1 blockchains could lead to significant year-over-year fluctuations within the predicted ranges.

Key Factors Affecting Solana Price

- Continued growth of stablecoin supply and DeFi use cases on Solana

- Regulatory clarity and global harmonization of crypto laws

- Technological upgrades improving scalability and transaction speed

- Increased institutional participation and TradFi partnerships

- Competition from other blockchains (Ethereum, Tron, etc.)

- Potential macroeconomic shocks and crypto market cycles

- Adoption of new Solana-native applications and cross-chain interoperability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

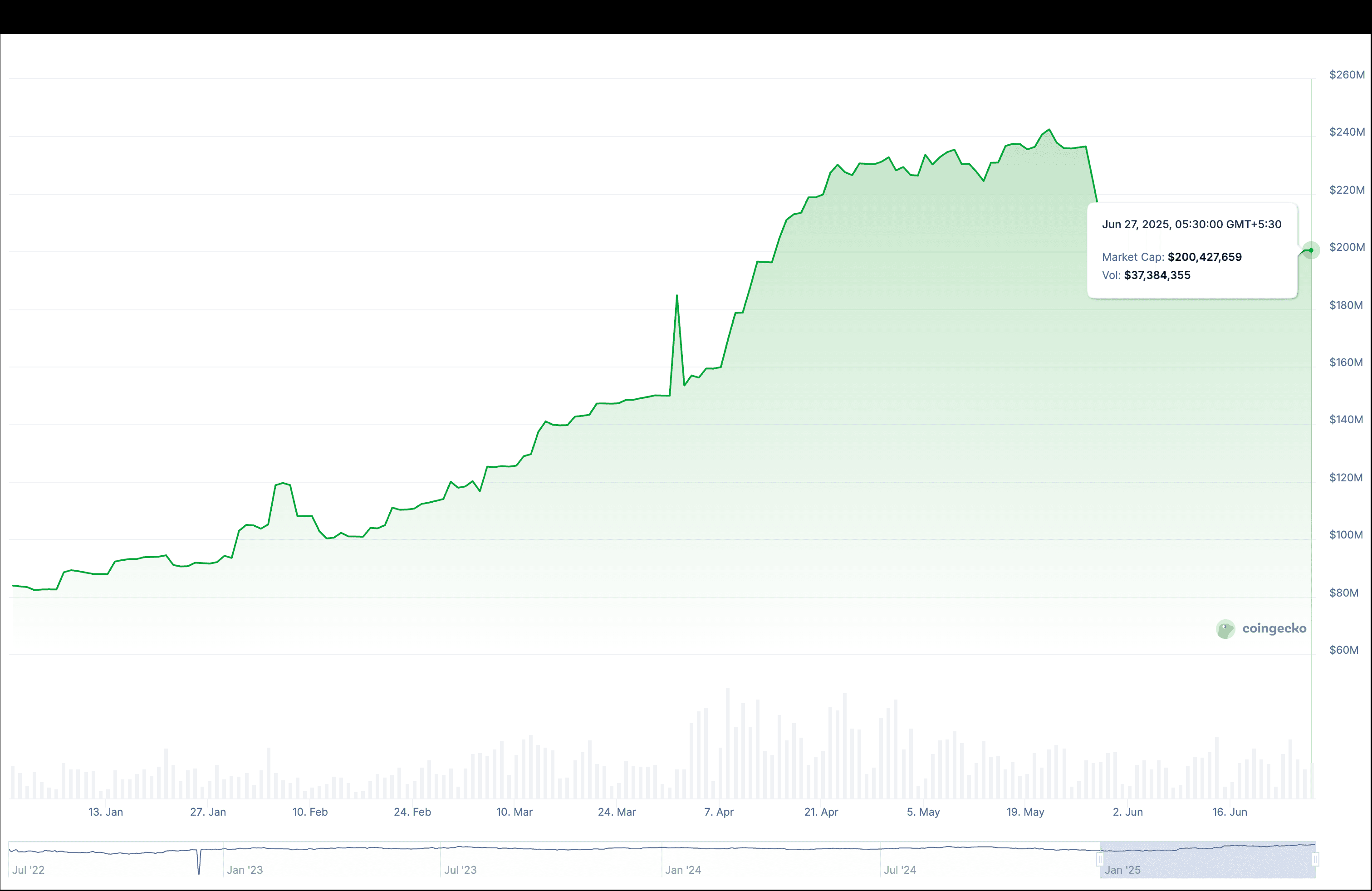

Major capital inflows and protocol launches are already in the pipeline, suggesting that Solana’s stablecoin ecosystem is far from peaking. With USDC dominance at 77% and Circle’s ongoing collaboration with institutional partners, the runway for further supply increases remains wide open. Developers are leveraging composability to introduce new DeFi primitives, while payment startups are piloting Solana-based cross-border solutions that could bring millions of unbanked users into the fold.

What sets Solana apart in this phase is not just speed or cost efficiency, but its ability to attract a diverse array of builders. From NFT marketplaces integrating instant stablecoin settlements to decentralized forex protocols and real-world asset tokenization platforms, the network is evolving into a financial superhighway for both crypto-native and traditional use cases.

The regulatory tailwinds cannot be overstated. As seen with the U. S. Senate’s stablecoin bill (Reuters), compliance clarity is unlocking pent-up demand from fintechs, neobanks, and even regional payment networks seeking blockchain rails. This is a marked contrast with previous cycles where regulatory uncertainty capped institutional participation.

Risks, Volatility and What to Watch

No rally is without risks. The rapid expansion of stablecoins on Solana has also sparked debate about concentration risk, both in terms of USDC’s dominance and reliance on a handful of custodians. Technical outages or exploits could still shake confidence, as could unexpected regulatory interventions outside the U. S.

Yet the data-driven reality is that Solana’s network resilience has improved markedly since its volatile periods in 2022-2023. Upgrades like Firedancer and localized fee markets have made congestion events rare even during periods of surging demand. If current trends hold, Solana may soon challenge Ethereum’s DeFi supremacy on at least some key metrics by year-end.

Solana Stablecoin Growth 2025: Key Takeaways for Investors

- Network Effects: Every dollar minted as a stablecoin deepens liquidity for DeFi protocols and attracts more builders to Solana.

- Regulatory Clarity: Recent U. S. legislation has reduced risk premiums around stablecoins, encouraging broader adoption.

- Ecosystem Expansion: From payments to gaming and NFTs, new use cases continue to drive organic demand for on-chain dollars.

- SOL Price Tailwinds: As total value locked (TVL) grows alongside stablecoin supply, SOL’s price at $205.18 (as of September 27) may see further upside if network activity accelerates.

The bottom line: With its $13.4 billion ATH in circulating stablecoins and breakneck ecosystem growth, Solana is no longer just catching up, it’s setting the pace for what programmable money can achieve at scale.