Solana Privacy Debate: Why ‘Crypto Without Privacy Is Not Crypto’ [Explained with Visuals]

![Solana Privacy Debate: Why ‘Crypto Without Privacy Is Not Crypto’ [Explained with Visuals]](https://b3-contents.b3.fun/articles/solana-privacy-debate-why-crypto-without-privacy-is-not-crypto-explained-with-visuals-1a6e96db-291f-4e68-b95e-97fc489ebcfa.png)

As the crypto market pivots into Q4 2025, the Solana privacy debate is heating up in parallel with a dramatic resurgence in privacy tokens such as Zcash. With Solana’s native token (SOL) trading at $204.64, up 4.15% in the last 24 hours, investors and developers are forced to confront a foundational question: Is crypto without privacy still truly crypto?

Privacy Tokens Surge: The Zcash Signal

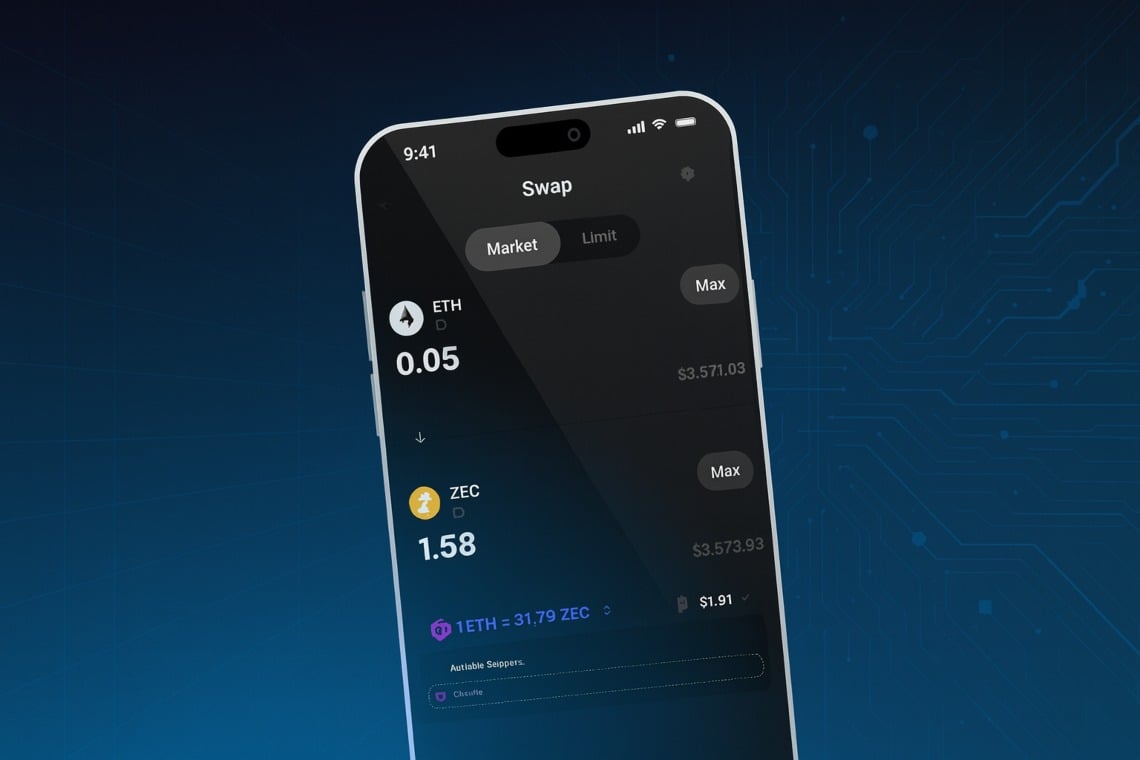

The latest rally in privacy coins provides important context for Solana’s evolving approach to onchain confidentiality. In September and October 2025, Zcash (ZEC) exploded by over 220%, reclaiming the $200 level and even touching $230 as private DeFi features went live (cryptoslate.com). This surge coincided with the launch of Zashi CrossPay, enabling private cross-chain shielded swaps and stoking speculation that privacy is more than a niche concern, it’s a core value for many users.

Key Insight: While Bitcoin cements its place as transparent digital gold, Zcash’s rise demonstrates that demand for confidential transactions remains robust, especially as regulatory scrutiny intensifies.

Solana’s Zero-Knowledge Pivot: Confidential Balances Explained

Solana has responded to these trends by introducing ‘Confidential Balances’, leveraging zero-knowledge cryptography to conceal transaction amounts and balances, without sacrificing the network’s signature speed or transparency. This suite of tools aims to strike a balance between user privacy and regulatory compliance, positioning Solana as a hybrid chain capable of serving both institutional and retail needs.

The move is not without controversy. Anatoly Yakovenko, Solana’s co-founder, has publicly stated that privacy alone does not constitute a ‘killer feature’ for mainstream adoption (mexc.com). His argument: most users prioritize speed, cost efficiency, and developer tooling over confidentiality. Yet projects like Elusiv are betting on zero-knowledge proofs to enable private swaps on Solana, while Privacy Cash pursues community-driven solutions for confidential transactions without issuing new tokens.

The central tension: Can Solana deliver meaningful privacy enhancements without alienating regulators or mainstream users who value transparency?

The Onchain Privacy Tradeoff: Security vs Transparency

The broader debate touches on more than technology, it’s about crypto philosophy. Advocates argue that true financial sovereignty depends on confidentiality; critics counter that absolute anonymity invites illicit activity and regulatory backlash. The recent integration of shielded transactions into DeFi protocols (as seen with Zcash) highlights both the potential upside, greater user protection, and the risks, regulatory uncertainty.

Pros and Cons of Increased Onchain Privacy in 2025

-

Pro: Enhanced User Confidentiality — Zero-knowledge tools like Solana’s Confidential Balances allow users to conceal transaction amounts and balances, protecting financial privacy without sacrificing network speed or transparency.

-

Pro: Greater Appeal for Privacy-Focused Investors — The 2025 surge in privacy coins such as Zcash (up over 220% in two weeks) demonstrates strong market demand for confidential transactions, especially as shielded features expand across DeFi.

-

Pro: Regulatory-Compliant Privacy Solutions — Projects like Elusiv and Privacy Cash are pioneering private swaps and confidential transactions on Solana, aiming to balance user anonymity with regulatory oversight, which could boost institutional adoption.

-

Con: Potential Regulatory Scrutiny — Increased privacy features may attract heightened attention from regulators concerned about illicit activity, possibly leading to exchange delistings or stricter compliance requirements for privacy-enabled assets.

-

Con: Limited Perceived User Demand — Solana co-founder Anatoly Yakovenko argues that privacy alone is not a ‘killer feature,’ suggesting that mainstream users may prioritize speed, cost, and usability over confidentiality.

-

Con: Technical Complexity and Integration Challenges — Implementing advanced privacy tools like zero-knowledge proofs can increase system complexity, potentially introducing new vulnerabilities or slowing network upgrades.

This dynamic is especially relevant for institutional players eyeing Solana at $204.64. As compliance requirements tighten globally, chains that can offer both selective transparency and robust privacy may capture outsized market share.

Where Next? Price Predictions Amid Privacy Mania

The resurgence of Zcash, and the rollout of Confidential Balances on Solana, has led some analysts to revisit their forecasts for privacy-focused assets heading into 2026. While short-term volatility is expected, structural demand for compliant yet private blockchain rails is likely to grow if current trends persist.

Solana (SOL) and Zcash (ZEC) Price Prediction Table (2026-2031) Under Privacy/Regulatory Scenarios

Forecasts reflect the interplay between privacy innovations, regulatory trends, and shifting crypto market sentiment.

| Year | Asset | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | SOL | $160 | $230 | $290 | ZK privacy tools gain moderate adoption; regulatory clarity emerges |

| 2026 | ZEC | $120 | $220 | $340 | Privacy demand rises; post-halving momentum |

| 2027 | SOL | $180 | $260 | $340 | Privacy tech scaled; DeFi/enterprise adoption rises |

| 2027 | ZEC | $135 | $260 | $410 | Privacy coins see regulatory pushback but user demand persists |

| 2028 | SOL | $200 | $300 | $400 | Privacy features become standard in layer-1s; global compliance improves |

| 2028 | ZEC | $150 | $290 | $470 | ZEC integrates with more DeFi; privacy narrative strong |

| 2029 | SOL | $180 | $320 | $470 | Market correction; privacy tech matures; regulatory uncertainty |

| 2029 | ZEC | $140 | $270 | $430 | Increased competition from new privacy protocols |

| 2030 | SOL | $220 | $360 | $540 | Mainstream adoption of privacy DeFi; bullish cycle |

| 2030 | ZEC | $170 | $320 | $520 | Privacy coins gain acceptance in select regions |

| 2031 | SOL | $250 | $410 | $630 | Widespread privacy adoption; regulatory frameworks harmonize |

| 2031 | ZEC | $190 | $370 | $610 | Privacy coins see renewed interest post-regulation harmonization |

Price Prediction Summary

Solana is poised for steady growth as it integrates privacy features while maintaining compliance, appealing to both institutional and retail users. Zcash benefits from the revived privacy narrative and recent technological upgrades, but faces regulatory headwinds and increasing competition. Both assets show strong upside if privacy becomes central to crypto adoption, but volatility and regulatory risk keep minimum price scenarios in play.

Key Factors Affecting Solana Price

- Regulatory clarity around privacy coins and protocols

- Adoption of zero-knowledge and privacy-preserving technologies

- Market sentiment towards privacy and compliance trade-offs

- Integration of privacy features into mainstream DeFi and payment solutions

- Competition from new privacy-focused projects and evolving blockchain standards

- Macro crypto market cycles and institutional participation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

However, the future of crypto privacy in 2025 is not solely a technical arms race. The social contract between users, developers, and regulators is being rewritten in real time. For every advocate championing ‘crypto without privacy is not crypto, ‘ there are skeptics who warn of unintended consequences if onchain privacy becomes too robust, potentially undermining the very legitimacy that mainstream adoption demands.

Solana’s hybrid approach – integrating zero-knowledge features like Confidential Balances while maintaining compliance hooks – signals a pragmatic path forward. This could allow for differentiated privacy tiers: retail users might opt for default transparency, while power users and institutions leverage confidential transactions for sensitive operations. Such flexibility could prove to be Solana’s unique selling point as the privacy narrative matures.

How Users Are Responding: Community Sentiment and Developer Activity

The community response to these changes has been mixed but increasingly engaged. Developers are experimenting with new primitives such as private swaps, stealth addresses, and selective disclosure frameworks. Meanwhile, user surveys show a growing appetite for tools that offer both convenience and confidentiality – especially among DeFi participants wary of surveillance or front-running.

How important are privacy features like ‘Confidential Balances’ to your use of Solana?

With Solana launching zero-knowledge-based privacy tools and privacy coins like Zcash surging, the crypto community is debating: Is privacy a must-have or just a nice-to-have? Share your view on how privacy impacts your use of Solana (SOL price: $204.64, +4.15% in 24h).

This groundswell is mirrored by rising developer activity in privacy-oriented Solana projects like Elusiv and Privacy Cash. Open-source contributions have increased since the launch of Confidential Balances, suggesting that builders see long-term value in privacy even if it isn’t yet the top demand driver.

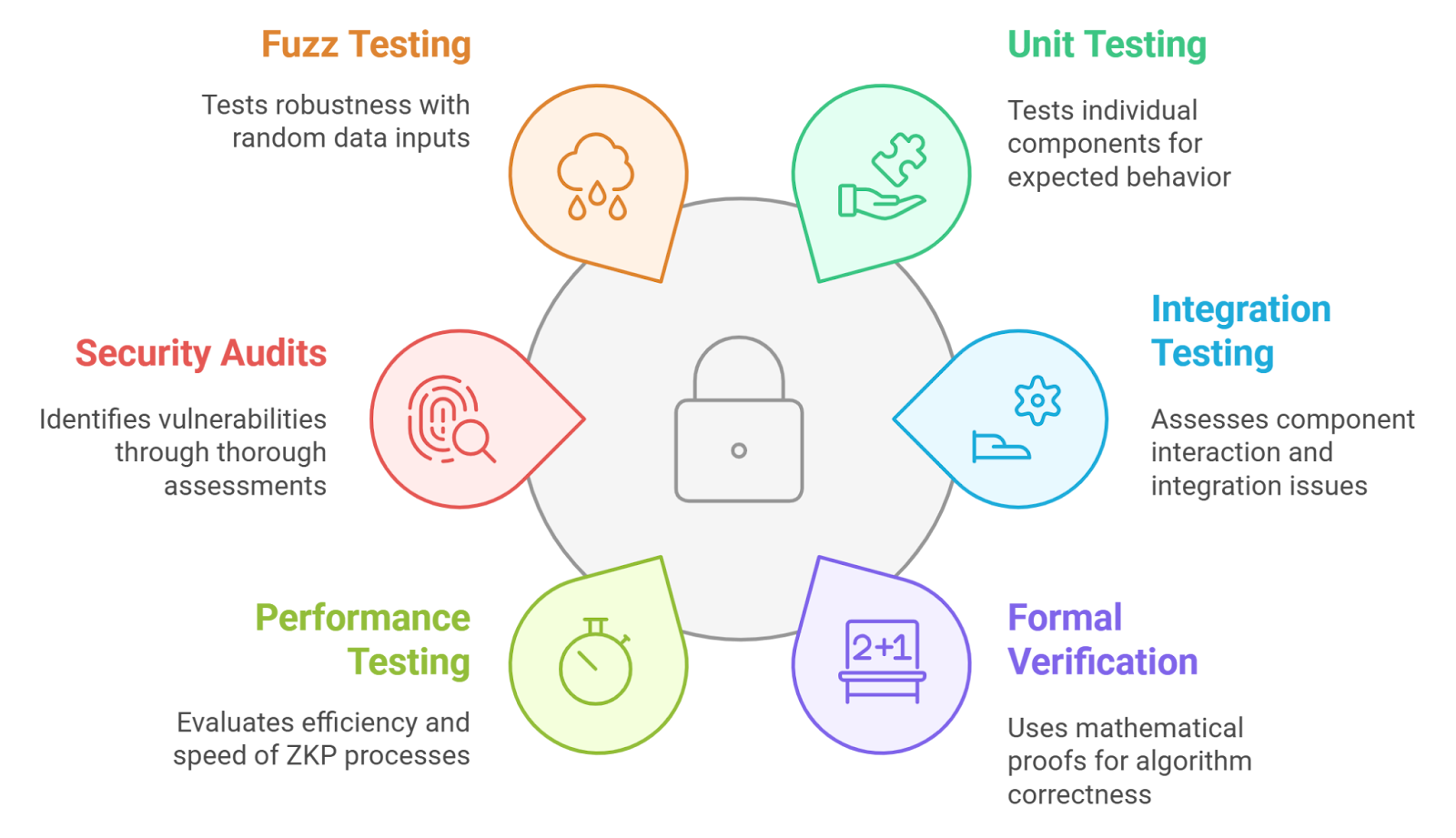

Visualizing the Privacy Landscape

To better understand where Solana stands in the evolving landscape, consider this visual breakdown:

- Solana: Fast settlement, optional Confidential Balances (ZK-based), selective transparency

- Zcash: Default shielded transactions (zk-SNARKs), cross-chain interoperability (Zashi CrossPay)

- Bitcoin: Full public ledger, limited privacy via coin mixing/Lightning Network

This comparative view reinforces why many believe Zcash Solana integration or similar cross-chain bridges could unlock powerful new use cases – combining scale with selective secrecy.

Risks and Unanswered Questions: Onchain Privacy Under Scrutiny

No discussion of onchain privacy would be complete without addressing its risks. Enhanced confidentiality can protect user data but may also complicate compliance monitoring or enable illicit flows if safeguards are lacking. As regulatory frameworks evolve rapidly worldwide, projects must tread carefully to avoid sudden crackdowns or blacklisting.

Key Risks & Mitigation Strategies for Onchain Privacy Tools

-

Regulatory Uncertainty: Privacy tools like Zcash and Railgun face evolving global regulations. Sudden crackdowns can impact user access and token liquidity.Mitigation: Projects increasingly integrate compliance features, such as selective disclosure and auditability, to balance privacy with regulatory requirements.

-

Transaction Traceability Risks: Even with advanced zero-knowledge cryptography, metadata leaks or improper implementation can expose user identities.Mitigation: Platforms like Elusiv on Solana employ robust ZK-proofs and encourage best practices for privacy-preserving transactions.

-

Liquidity Fragmentation: Privacy pools can fragment liquidity, making it harder to swap assets efficiently or at scale.Mitigation: Integrations with multichain DEX aggregators (e.g., ShapeShift) and cross-chain shielded swaps (e.g., Zcash’s Zashi CrossPay) help unify liquidity while preserving privacy.

-

User Experience Complexity: Privacy tools often require extra steps or technical know-how, potentially deterring mainstream adoption.Mitigation: Solutions like Privacy Cash focus on seamless, user-friendly interfaces for confidential transactions on Solana, lowering the barrier to entry.

-

Network Performance Trade-offs: Adding privacy layers can slow transaction throughput or increase fees.Mitigation: Solana’s Confidential Balances use efficient ZK cryptography to conceal transaction amounts while maintaining high speed and low fees—SOL is currently priced at $204.64 (+4.15% 24h).

The next 12 months will be pivotal. If Solana can maintain its performance edge (SOL at $204.64) while offering credible privacy guarantees that satisfy both users and regulators, it could set a new standard for hybrid blockchains globally.

Bottom line: The Solana privacy debate is far from settled – but one thing is clear: as crypto matures into mainstream finance, the chains that master both transparency and confidentiality will likely lead the next wave of adoption.