Solana’s relentless push for speed and efficiency is reshaping the landscape of institutional crypto trading. The latest signal: Bullish, a regulated global digital asset platform, has kicked off a strategic migration of its core trading infrastructure to Solana-native stablecoins. This move is not just a technical upgrade – it’s a bold bet on the future of real-time, on-chain finance.

Bullish’s $1.11B IPO and the Solana Stablecoin Pivot

July 2025 marked a watershed moment for both Bullish and Solana. On the heels of Bullish’s $1.11B IPO debut on the NYSE – which propelled its valuation to $5.41B (source) – the company announced a sweeping collaboration with the Solana Foundation. The goal: make Solana-native stablecoins central to all exchange operations, from custody and payments to trading and settlement (source).

This pivot comes as Solana cements its position among the top three stablecoin blockchains globally, commanding a market cap near $10.9 billion (source). For traders and institutions alike, this isn’t just about hype – it’s about unlocking tangible efficiency gains in capital markets.

Why Institutions Are Betting on Solana-Native Stablecoins

Legacy trading infrastructure is riddled with friction: slow settlement times, high fees, and operational silos between exchanges and custodians. By integrating Solana-native stablecoins at its core, Bullish aims to slash these inefficiencies:

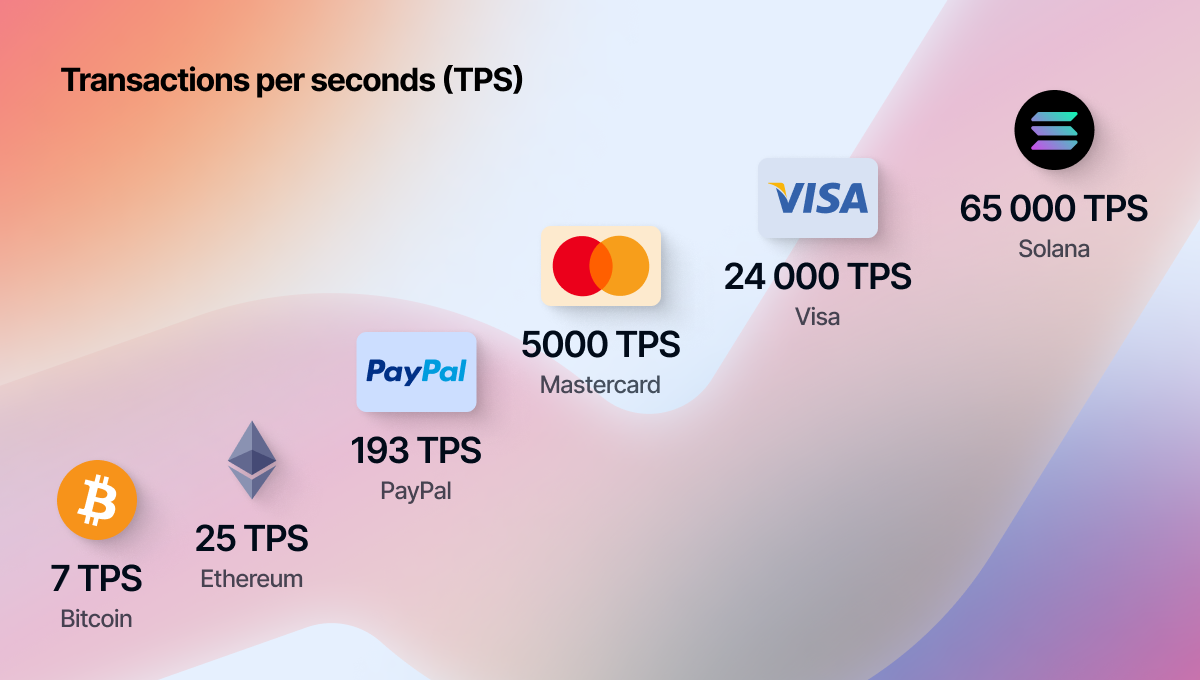

- Lightning-fast settlements: Solana routinely handles thousands of transactions per second with sub-second finality.

- Ultra-low costs: Transaction fees are measured in fractions of a cent – ideal for high-frequency strategies.

- Programmable payments: Native stablecoins enable automated clearing, margin management, and real-time risk controls.

This is particularly relevant as institutional volumes surge; Bullish alone is committing up to $23 billion in daily volume through this upgraded infrastructure (source). For traders accustomed to T and 2 settlement cycles or expensive wire transfers, Solana-native stablecoins offer an entirely new paradigm.

SOL Maintains Strength Above $195 as Open Interest Hits Records

The market has taken notice. As of August 14,2025, Binance-Peg SOL (SOL) is trading at $196.96, with recent highs reaching $209.94 and lows at $195.15 over the past 24 hours (source). This strong price action reflects not just speculative momentum but growing confidence in Solana’s role as institutional-grade infrastructure for digital assets.

Solana (SOL) Price Prediction 2026-2031

Forecast based on institutional adoption, Bullish-Solana partnership, and evolving market conditions as of Q3 2025.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg %) | Key Scenario / Notes |

|---|---|---|---|---|---|

| 2026 | $165.00 | $225.00 | $295.00 | +14% | Potential consolidation post-2025 rally; continued institutional adoption supports price floor. |

| 2027 | $180.00 | $260.00 | $340.00 | +15% | Steady growth driven by increased DeFi/TradFi integration and expanding stablecoin volumes. |

| 2028 | $210.00 | $305.00 | $410.00 | +17% | New ATH potential if macro conditions remain favorable; regulatory clarity improves outlook. |

| 2029 | $250.00 | $355.00 | $480.00 | +16% | Network upgrades and global stablecoin use accelerate adoption; competition with Ethereum/Layer 2s continues. |

| 2030 | $295.00 | $410.00 | $560.00 | +15% | Mainstream adoption of Solana-based stablecoins; possible market rotation into high-utility chains. |

| 2031 | $340.00 | $465.00 | $650.00 | +13% | Mature ecosystem, with Solana as a core institutional settlement layer; market cycles may cause volatility. |

Price Prediction Summary

Solana’s price outlook for 2026-2031 remains bullish, underpinned by major institutional partnerships like Bullish’s adoption of Solana-native stablecoins. While crypto market cycles introduce volatility, Solana’s high throughput, low fees, and growing stablecoin ecosystem position it as a leading blockchain for institutional and DeFi applications. Price ranges reflect both the upside of continued adoption and the downside risk from market corrections or regulatory hurdles.

Key Factors Affecting Solana Price

- Institutional adoption (e.g., Bullish, other exchanges) driving on-chain volume

- Growth of Solana-native stablecoin ecosystem and DeFi integration

- Macro crypto market cycles and Bitcoin halving effects

- Regulatory developments globally, especially for stablecoins and trading platforms

- Technological upgrades (e.g., scalability, security) and Solana’s resilience to outages

- Competition from Ethereum, Layer 2s, and emerging blockchains

- Potential for new enterprise and retail use cases on Solana

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Bullish’s migration signals that major financial players are no longer content sitting on the sidelines; they want direct exposure to blockchain rails that can handle real-world scale without compromise.

For institutional traders, the implications are clear: Solana-native stablecoins are more than just a technical upgrade. They’re a strategic lever for unlocking capital efficiency, automating compliance, and enabling 24/7 settlement cycles. With Bullish’s infrastructure overhaul, we’re witnessing the first wave of regulated entities betting their business on Solana’s throughput and reliability.

What This Means for Crypto Custody and Payments

Crypto custody has historically been plagued by fragmented systems and manual processes. By tapping into Solana’s composable architecture, Bullish can now offer real-time asset movement between exchange, cold storage, and third-party custodians, all settled with Solana-native stablecoins. This not only reduces counterparty risk but also streamlines treasury operations for funds, market makers, and corporates.

On the payments front, programmable stablecoins unlock new models for on-chain payrolls, instant cross-border settlements, and automated fee reconciliation. Imagine executing a multi-million dollar trade at 2 AM UTC and having post-trade settlement finalized in seconds, no wire cutoffs or banking delays. That’s now reality for Bullish clients leveraging Solana’s rails.

Key Benefits of Solana-Native Stablecoins for Institutions

-

Ultra-Fast Settlement Speeds: Solana’s blockchain enables near-instant settlement of trades, dramatically reducing counterparty risk and enabling real-time clearing for institutional clients.

-

Significantly Lower Transaction Costs: Solana-native stablecoins offer minimal transaction fees, allowing institutions to execute large volumes of trades and settlements cost-effectively—ideal for high-frequency trading environments.

-

Robust Scalability for High-Volume Trading: Solana’s architecture supports thousands of transactions per second, making it suitable for the demands of institutional-grade trading and settlement operations.

-

Enhanced On-Chain Transparency and Security: All stablecoin transactions on Solana are recorded on-chain, providing auditable, transparent records and strong security for institutional compliance.

-

Seamless Integration With Bullish’s Regulated Platform: The collaboration between Bullish and Solana Foundation ensures that stablecoins are integrated into a regulated, global trading infrastructure, supporting custody, payments, and settlements for institutions.

Bridging Centralized and Decentralized Finance

The Bullish-Solana partnership is also a bellwether for the convergence between centralized exchanges (CEXs) and decentralized finance (DeFi). By embedding stablecoins that are natively interoperable with DeFi protocols on Solana, Bullish is future-proofing its offering, giving institutions seamless access to both traditional order books and emerging on-chain liquidity venues.

This hybrid approach doesn’t just boost efficiency; it sets a new standard for transparency. On-chain settlement logs provide auditable proof of reserves and trade flows, critical as regulatory scrutiny intensifies post-IPO (source).

Solana Payments 2025: A New Baseline for Market Infrastructure

The ripple effects extend far beyond one exchange or blockchain. As other platforms take note of Bullish’s playbook, and as USDC volumes swell across Solana, the expectation is clear: real-time payments, automated settlements, and programmable assets will become table stakes in crypto markets by late 2025.

For traders eyeing SOL at $196.96, this isn’t just about price speculation. It’s about participating in an ecosystem where speed, cost-efficiency, and transparency aren’t buzzwords, they’re built-in features powering billions in daily volume (source).

The bottom line: The migration of Bullish’s infrastructure to Solana-native stablecoins marks a definitive shift toward next-gen trading rails, where custody risk drops, operational friction fades away, and the line between CeFi and DeFi blurs for good. For forward-thinking institutions (and savvy retail traders), now is the time to recalibrate strategies around these new market realities.